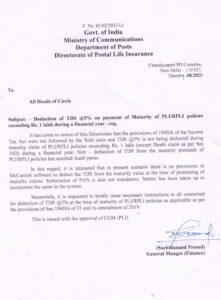

No. 65-02/2023-LI Govt. of India

Ministry of Communications

Department of Posts

Directorate of Postal Life Insurance

Chanakyapuri PO Complex, New Delhi-110 021.

Dated 22.09.2023

To

All Heads of Circle

Subject: Clarification / guidelines regarding deduction of TDS on payment of PLI/RPLI policies, as applicable, under section 194DA of IT Act 1961.reg.

Kindly refer to this Directorate letter dated 09.08.2023 wherein instructions were issued regarding deduction of TDS on PLI/RPLI payments, as applicable, under Section 194DA of IT Act 1961.

In this regard certain circles have been seeking clarification/guidelines with regard to the applicability of TDS on PLI/RPLI payments and non-provision of TDS deduction in McCamish software.

Keeping this in view, following clarification/ guidelines are issued for smooth and timely payouts of PLI/RPLI policies to the insurants:

1) Implications with examples of TDS applicability on PLI/RPLI payment as per Section 194DA with exemption under clause10(D) of section 10 of Income Tax Act 1961 are given in Annexure.

2) Since there is no provision to deduct the applicable TDS in McCamish software at the time of processing of PLI/RPLI claims, below mentioned procedure may kindly be followed till the incorporation of the same in McCamish IT 1.0 or IT 2.0 project whichever is earlier:

a) Payment of PLI/RPLI policies where TDS is not deductible as explained in para 1 above, shall be processed as per existing rule/guidelines.

b) Payments of PLI/RPLI policies in which TDS is applicable, shall be processed for payment after deducting applicable TDS through Cheque or NEFT only. Status of such PLI/RPLI policies be changed as “PAID” in McCamish software to avoid duplicate payment.

c) TDS shall be deducted wherever applicable @5% in case insurant submits PAN. In case PAN is not submitted by insurant, TDS shall be deducted @20%.

d) TDS shall not be deducted if sum is paid on the death of insured person.

3) At present, deducted TDS amount on PLI/RPLI payments, are to be credited under MH 0021-00-102-09-00-00- Deduction from Insurance commission etc. under Sec 194-D & GL Code- 8002100150. On receipt of regular GL. Code for TDS deduction, reversal entries are to be made which will be communicated in due course.

4) A register is to be maintained by the HOS for PLI/RPLI policies on which applicable TDS are deducted and a monthly consolidated report on TDS amount deducted on PLI/RPLI claims (GL balance) should be sent to respective GM (PA&F) by 10th of the following month for monitoring and reconciliation.

Encl: As above.

(Sachidanand Prasad)

General Manager (Finance)

Copy for kind information to: All Heads of PAO