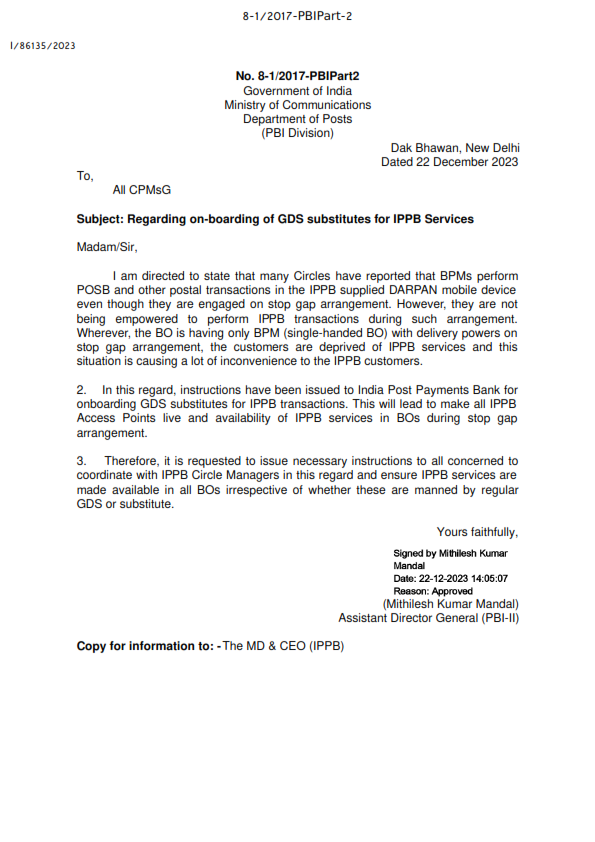

Category: IPPB Services

IPPB Services

To extend POSB/IPPB Services in one Post Office per Division from 08.00 AM to 08.00 PM for Customers – Gujarat Circle

भारतीय डाक विभाग DEPARTMENT OF POSTS: INDIA ( संचार मंत्रालय) (Ministry of Communications) मुख्य पोस्ट…

Regarding provision of substitute arrangement as per prescribed rules – Bihar Circle Estt Letter dated 15/12/2023

भारतीय डाक विभाग DEPARTMENT OF POSTS, INDIA. कार्यालय: चीफपोस्टमास्टरजनरल, बिहार सर्किल, पटना- 800001. O/o the…

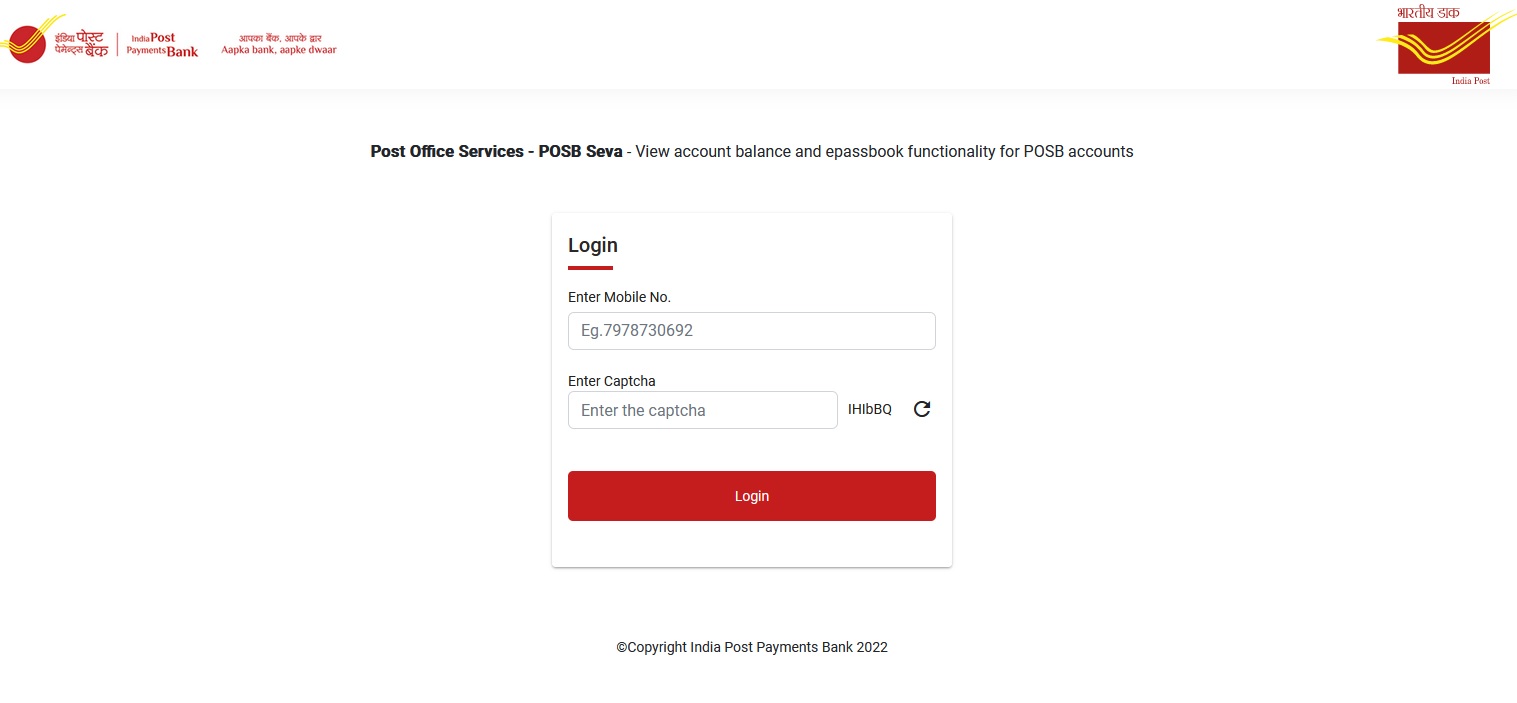

How to Check Post Office Account Balance Enquiry Online – ePassbook for POSB schemes

ePassbook for POSB schemes Click Here to Check Post Office Account Balance The Department of…

India Post Payment Bank – IPPB Regular Savings Account

The Regular Savings Account can be opened at the bank’s access points and your doorstep.…

India Post Payment Bank – IPPB Basic Savings Account

India Post Payment Bank – IPPB Basic Savings Account This savings account has all the…

India Post Payment Bank – IPPB Digital Savings Account

Digital Savings Account For the people who are tech savvy and comfortable with technology, IPPB’s…

India Post Payment Bank – IPPB Premium Savings Account

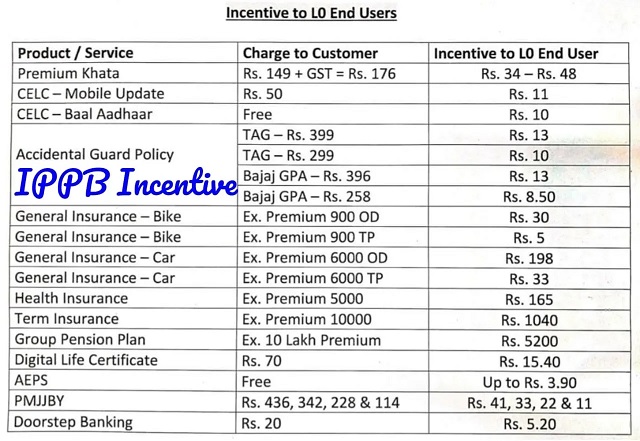

Premium Khata is a variant of IPPB Savings Bank Account which is offered to customers…

What are the benefits of IPPB QR card?

QR Card IPPB QR card redefines the way banking is done. It provides a unique,…

IPPB Android Mobile App – How to Download and Register on it ?

Mobile App IPPB offers a state-of-the-art, simple, secure and easy-to-use Mobile banking service through a…

Service Charges / Fees for IPPB Digital Savings Account

Eligibility Anybody above 18 years with KYC Initial Minimum Deposit NIL Minimum Account Balance NIL…